Calculate additional medicare tax

An employee will pay 145 standard Medicare tax plus the 09 additional Medicare tax for a total of 235 of their income. What is the additional Medicare tax.

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Even if you are self-employed the 29 Medicare tax applies.

. A person who is self-employed will pay 29. Employers and employees split the tax. If you are a high earner you are subject to the 09 additional Medicare tax on earned income in excess of the threshold amount.

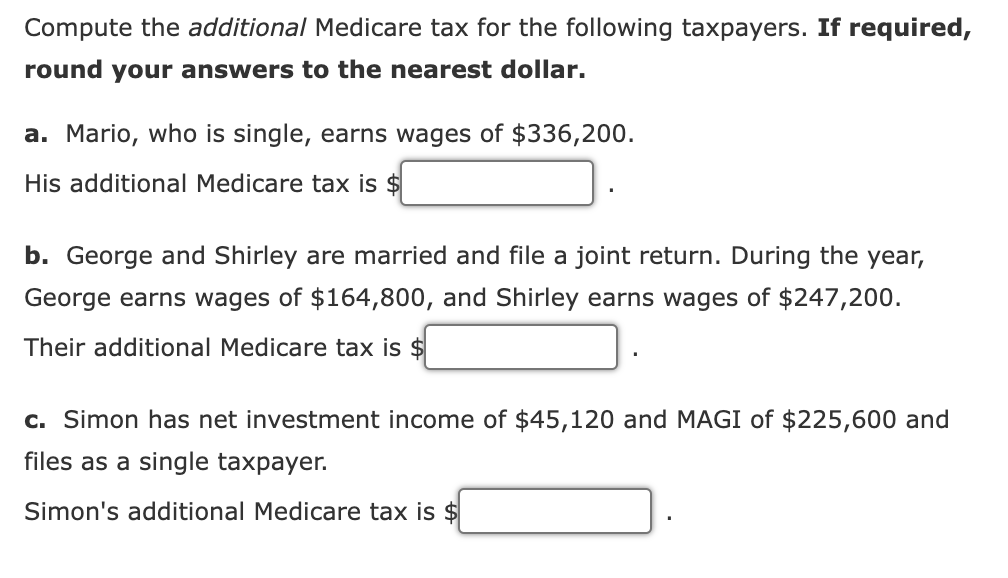

The additional Medicare tax of. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld. For both of them the current Social Security and Medicare tax rates are 62 and 145.

To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates. How is additional Medicare tax calculated. For example if an employees taxable wages are 700.

Under this mandate in addition to withholding Medicare tax at 145 employers must withhold a 09 Additional Medicare Tax from wages paid to an employee once earnings reach 200000. The self-employed tax consists of two parts. Once you complete Form 8959 and figure out the total Additional Medicare Tax youre responsible for the final section of the form subtracts the tax you paid through paycheck withholding as shown on your W-2.

How To Calculate Additional Medicare Tax 2019. Perfect answer Based on the Additional Medicare Tax law all income for an individual above 200000 is subject to an. Employees self-employed individuals and others must use IRS Form 8959 to calculate their Additional Medicare Tax liability on their individual income tax returns.

Based on the Additional Medicare Tax law all income for an individual above 200000 is subject to an additional 09 tax. The result shows if there is any Additional Medicare Tax duewhich ultimately gets reported on your 1040 form. To calculate how much your additional Medicare tax is you need to determine how youre filing your taxes how much your salary is and how much your salary exceeds the.

Therefore his Additional Medicare Tax bill is. Medicare taxes for the self-employed. Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld.

124 for Social Security. You just need to click to get the search information Additional. There are two additional Medicare surtaxes that apply to certain high earners.

How To Calculate Additional Medicare Tax Properly. How Do You Calculate Medicare Tax. Additional Medicare Tax Calculator is a platform created to assist users in taking care of themselves and their families.

The threshold amounts are based on your filing status. The additional tax 09 in 2022 is the sole responsibility of the employee and is not split between the employee and employer. The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000.

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Additional Medicare Tax Detailed Overview

Additional Medicare Tax Calculator With How Why What Explanation Internal Revenue Code Simplified

Solved In 2021 Bianca Earned A Salary Of 164 000 From Her Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

2

What Is Medicare Tax Definitions Rates And Calculations Valuepenguin

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Complete Irs Form 8959 Additional Medicare Tax Youtube

3 Types Of Medicare Tax Break Down Example In Golden Years Moneytree Software

Aca Tax Law Changes For Higher Income Taxpayers Taxact

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

How To Calculate Additional Medicare Tax Properly

Additional Medicare Tax Detailed Overview

How To Calculate Additional Medicare Tax Properly

How To Calculate Additional Medicare Tax Properly

How To Calculate Additional Medicare Tax Properly